How many credit cards should you own? This is a question many often wonder. And many often assume the answer is as few as possible. But what you may not know, is that that isn’t exactly true. In fact, quite the opposite. What if we told you, you can’t really have too many credit cards? And that when managed properly and responsibly, it can actually be beneficial?

WHY IS USING CREDIT CARDS IMPORTANT?

So why are we talking about credit cards? Well, credit cards can be an amazing tool when used properly to help offset the out of pocket expenses associated with travel. Many credit cards offer some form of rewards in return for using their card. Maybe it’s cash back, maybe it’s airline miles or hotel points, or maybe it’s points which can be used for a multitude of things. You can read more about using points and miles to book travel in our Booking Travel with Points and Miles post.

Using credit cards for all of your every-day expenses can be a big shift from how many are used to managing their finances. Cash, checks and debit cards are NOT a bad way of paying for things. These methods help ensure that one does not spend beyond their means. They just do not offer any return for using those methods of payment. Using credit cards that are tailored to your shopping habits though, can provide massive dividends if you are a traveler or aspiring traveler. You want your money working for you, not against you. And using multiple credit cards can not only elevate your ability to cover out of pocket expenses, but they can also elevate your credit score as well!

CREDIT CARD MISCONCEPTIONS

There is a massive stigma when it comes to having multiple credit cards. We are taught that having numerous credit cards is a bad thing and will hurt your credit which can have massive implications depending on your long-term plans and goals. Now, if not managed properly and responsibly, this stigma can very easily become a reality. If you have large amounts of debt, or are unable to make your monthly payments on time, then adding more credit cards to your portfolio may not be the best idea. We would however recommend looking at the credit cards you currently have and making sure they are working for you and not against you.

If you do not have large amounts of debt, or are at the very least able to manage your finances responsibly, then having multiple credit cards can help you in many ways. Let’s start with your credit score.

HOW IS YOUR CREDIT SCORE CALCULATED?

First, there are three major credit bureaus which nearly all companies rely on to evaluate ones credit: TransUnion, Experian and Equifax. Each of these companies calculates credit scores slightly differently, and so checking your credit score with each one may result in a slightly different number. But they all have 5 weighted categories that they look at when calculating these scores:

- Payment history – 35%

- Amount you owe – 30%

- Length of credit history – 15%

- New credit opened – 10%

- Types of credit you have – 10%

Let’s dive in to each of these a little deeper.

PAYMENT HISTORY

FICO which is a well known credit data analytics company defines payment history as showing “how you’ve paid your accounts over the length of your credit. This evidence of repayment is the primary reason why payment history makes up 35% of your score and is a major factor in its calculation”. In a nutshell, have you made payments on time consistently, have you had a history of late payments, have you paid at least the minimum payments consistently etc. 35% is a huge chunk of your credit score, so making sure you make your payments regularly and in full is crucial.

TIP: Your goal should be to pay off each of your credit cards in full, every single payday. If you spend $1,000 every two weeks on groceries, gas, bills, etc., then you should pay off that $1,000 in full on the next payday. This will not only help prevent increasing debt, but it will show these credit bureaus that you can manage money responsibly.

AMOUNT YOU OWE

Amount owed quite literally means the total amount of debt one carries. But it also refers to your credit utilization. This means that if your credit card limits total $10,000, and you have $9,500 in debt, your utilization is 95%. This can show that you are spending beyond your means or that you are overextended. This category accounts for 30% of your credit score, and with good reason.

TIP: Your goal should be to have as low of a utilization as possible. This number can be a clear indicator of whether you can or should add to your credit card portfolio. If your utilization number is higher than 30%, then this should be your focus area for improvement.

LENGTH OF CREDIT HISTORY

Length of credit history looks at three things:

- How long your oldest account has been open

- How long your newest account has been open

- An average length of time all of your accounts have been open

Each line of credit is evaluated individually, so if you have 1 credit card with perfect payment history and low utilization, but you’ve only had it open for 1 year, and then you have 3 cards with poor payment history and high utilization which have been open for 5 years, the blend of these cards is going to result in poor credit.

TIP: Having credit cards open for long periods of time can be a good thing, but you also want to make sure these cards have good history. Having credit cards open for a long time that have bad credit history, isn’t going to help.

NEW CREDIT OPENED

FICO defines new credit opened as: “New credit makes up 10% of a FICO® Score. When you apply for new credit, inquiries remain on your credit report for two years. FICO Scores only consider inquiries from the last 12 months.”

TIP: It is important NOT to get hung up on this. When signing up for a new credit card, your credit score will have a minor reduction in your credit score. This is usually between 2-10 points depending on your credit history. And while this is not ideal, the key to remember is that if you can manage your credit properly, these 2-10 points will easily bounce back within a few months. Continue to improve your credit, and your credit could jump 2-3x that amount a few months later.

TYPES OF CREDIT YOU HAVE OR CREDIT MIX

“The types of credit you have are known as your credit mix. They can include a mix of accounts from credit cards, retail accounts, installment loans, finance company and mortgage loans.“

Like everything financial, it’s good to have diversity in your credit. Having a history of managing multiple types of credit well can show lenders you know how to manage your finances and credit responsibly. This can help tremendously if you have plans to make any large purchases like a car or a home.

TIP: If you’re just starting out at building your credit, consider signing up for something like a gas station credit card and only using the card for purchasing gas for your vehicle. This will help you keep your utilization down on this specific card and show regular purchases and payments. This coupled with some other types of credit will help diversify your credit.

HOW TO CHECK YOUR CREDIT SCORE

It’s important to keep tabs on your credit score and to always have goals as well as plans on how to achieve those goals in mind. And one of the first steps to doing this is knowing your credit score. So how do you check your credit score. Well there are a few ways:

- You can go directly to the credit bureaus listed above (TransUnion, Experian and Equifax) to run a credit report.

- Check third party websites like FICO or CreditKarma.com which pull data from the above credit bureaus.

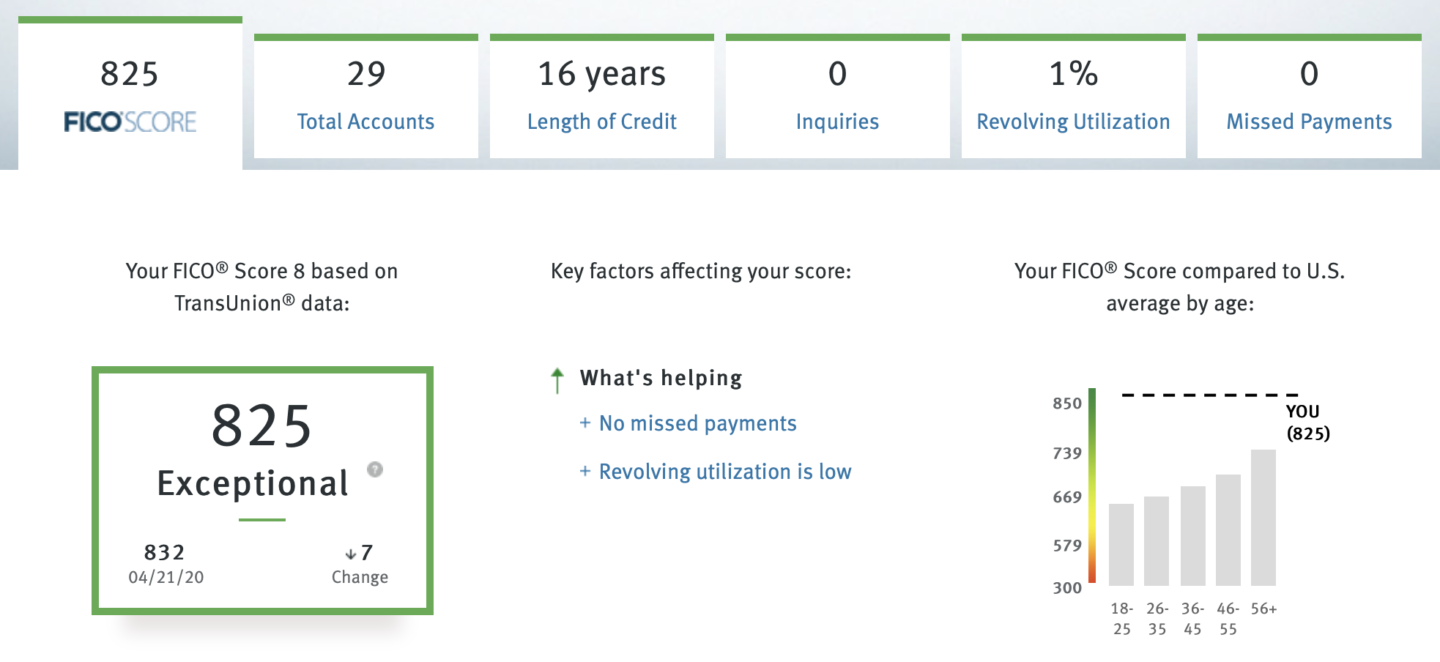

- Our recommendation would be to first check your existing credit card portals. Many credit card companies allow you to check your FICO score for free right from your account like Discover does as shown above.

USING MULTIPLE CREDIT CARDS TO YOUR ADVANTAGE

So how would owning and using multiple credit cards benefit you?

- First, as we mentioned above, diversifying your credit will help you improve your credit score. Building and improving your credit should be your number 1 priority.

- Most of the credit cards we mention, come with a sign-up bonus. See our Booking Travel with Points and Miles for a list of some of our recommended cards. So signing up for multiple credit cards over time, can get you hefty amounts of points which you can then combine and use to book travels with.

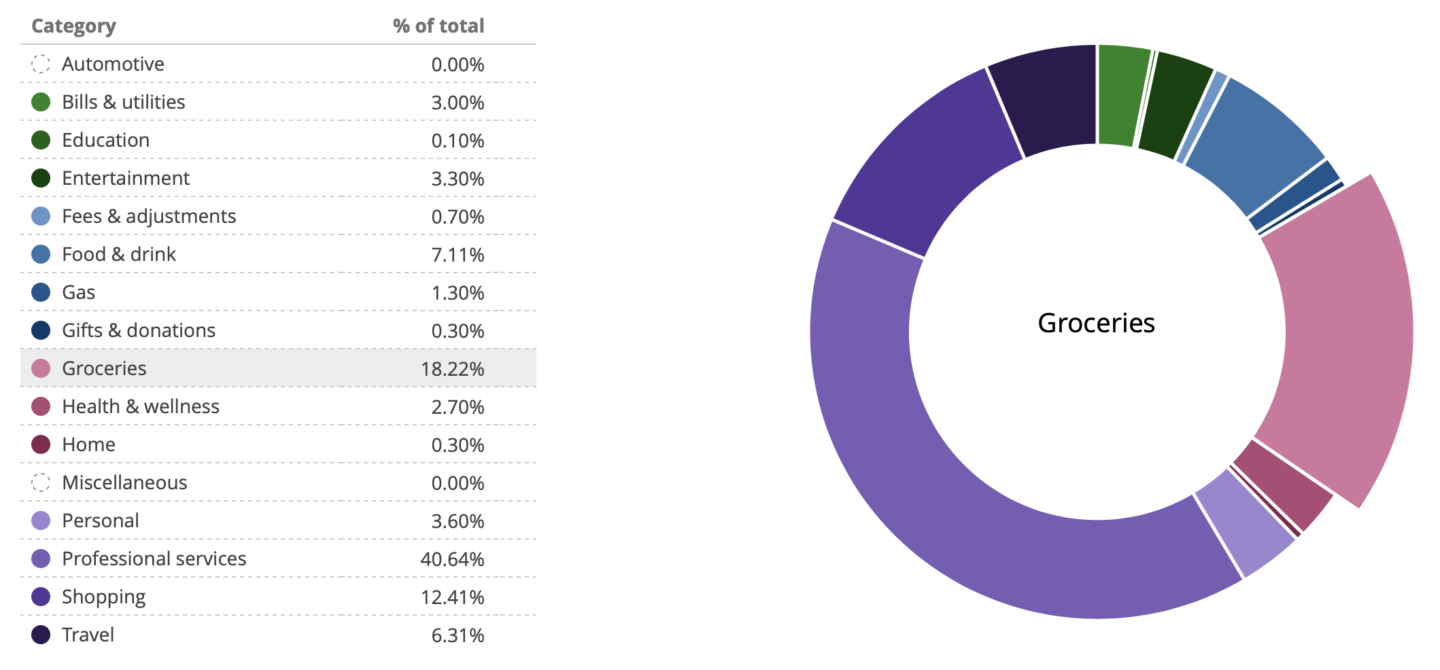

- Each credit card has its own perks and spending categories in which you earn your rewards. So let’s say you have one card that gets you 3x points on groceries, another that gets you 3x points on travel, and another that gets you 3x points on entertainment. Using each of these in their respective categories will get you the highest return for each card.

TIP: Make sure you’re using your cards in the right places. If you only use one card, look at your credit card statement to see what your highest spend categories are. If the perks of your card don’t align with your highest spend categories (example: your card gets 3x points on entertainment, but entertainment is your lowest spend category), then you may want to consider getting a card that aligns better with your spending habits.

ANOTHER TIP: If you are married or have a spouse, it may be beneficial to consider adding each other as authorized users on each others cards. This can help you both build your credit, as well as help you both achieve your sign-up bonus requirements for new cards as well as continue to build up your points for those cards.

CONCLUSION

So how many credit cards should you own? Well there really isn’t a right answer. Many of the leading experts in using credit cards and especially using for points and miles redemptions have upwards of 20-30 credit cards open at any given time, like Brian Kelly, The Points Guy. Knowing how many credit cards to own is really dependent on your own personal situation, your financial goals and your priorities.

So what’s in our wallet? Between the two of us we have 11 cards (Ryan 7, Katy 4). Each card has a specific use and each are working together to help us cover travel expenses like flight and hotel costs. But we have 4 cards from Chase that we use quite exclusively:

- Sapphire Reserve – 50,000 point sign-up bonus

- Sapphire Preferred – 60,000 points sign-up bonus

- World of Hyatt – 50,000 points sign-up bonus

- Ink Business Preferred – 100,000 points sign-up bonus

3 out of the 4 cards listed here are part of Chase’s Ultimate Rewards Program which allows us to utilize all the points we get from those cards across many different travel partners. Having flexibility in how you use your points means you can take advantage of deals across many different travel companies as opposed to being tied to specific brands or companies.

While this is more of a lesson on credit card management, credit cards can play a huge role in being able to travel either more frequently, or at lower costs. So we hope you’ve learned something here, and feel free to comment below and let us know what you think!

Disclaimer: We are not accountants or financial advisors, and thus are not responsible for any actions taken based on the information provided below. These are simply our own observations based on our own experiences. Please see a financial advisor if you have any specific questions or are seeking specific advice regarding your own personal finances.