Imagine yourself laying by the pool of tropical resort, or sipping coffee on the balcony of a beautiful hotel overlooking the Eiffel Tower. Now imagine getting to do this without paying for your stay at said locations. Even better, imagine not having to pay for the flights to get to these locations! Do we have your attention? Good, because this is no trick. While this may sound way too good to be true, it isn’t. The concept of using points and miles for travel redemptions is no new thing. But what many don’t know or realize, is just how simple it is to do. So let’s get in to it and consider this a beginners guide to booking travel with points and miles.

WHAT ARE POINTS AND MILES?

Points and miles are what you earn from airline frequent flier programs, hotel loyalty programs, as well as a number of different major credit card company programs. These points may be earned from flights you take, stays at hotels, or the spending you put on certain credit cards. As you accumulate these points and miles, you can then redeem them for many different things, including food, clothing, and electronics. But what we’re really here to talk about is redeeming them for free (or reduced) flights and hotel stays.

THE BENEFITS

Before we jump in to how to do it the right way, let’s talk about some of the benefits. Besides the obvious benefit of getting to reduce out of pocket expenses associated with taking trips and vacations, there are a number of other benefits to using points and miles.

First, in many cases, it can be done without having to change your spending habits. The main idea is NOT to spend more money to accumulate points and miles, it is to maintain (or improve) your spending habits so that you earn more efficiently. Or get a better return on your spending. Instead of you working harder, make these loyalty programs and credit cards work for you.

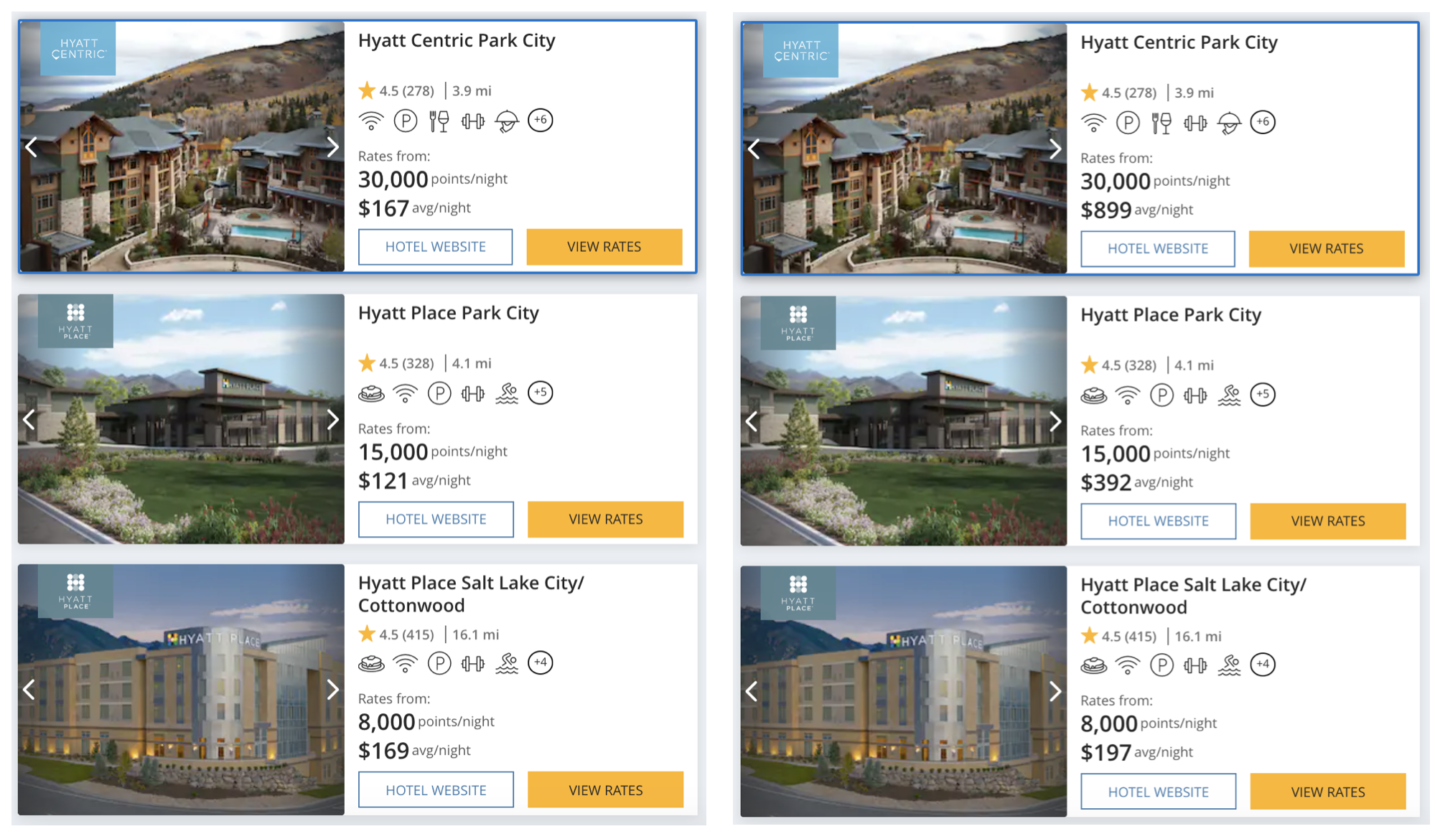

Second, without getting in to the nitty gritty details of loyalty programs, more often than not, points and miles redemptions stay relatively unchanged no matter the time of year or season. This is really where you can get some massive returns. Imagine going to Vale Colorado, or Times Square for Christmas. Or imagine going to Hawaii during spring break or (insert any other ideal travel destination during the peak season for that location). Paid flights and paid hotel stays during these peak seasons can sometimes be outrageously high. Thousands of dollars for round trip flights and hundreds of dollars per night for hotel stays. But when it comes to points and miles redemptions, the amount of points or miles you need to book a peak season flight or hotel stay, are nearly identical to those during non-peak seasons. Lets take a look at an example:

In this example, from Hyatt, you’ll see that a stay at the beautiful Hyatt Centric in Park City Utah in October, will cost you only $167 or 30,000 points per night. But stay at the same location 2 months later in December, and that $167 per night turns in to $899 per night! You’ll also see that the points redemption cost stays the same at 30,000 points per night. So you’re far better off using your points to stay during peak season when the cash cost is 5x higher.

Now many of the different loyalty programs like Marriott Bonvoy, and United Airlines MileagePlus, have begun introducing dynamic award charts for redemptions, meaning the amounts needed to redeem could change between non-peak and peak seasons. Even with those changes though, the value you are getting out of the points and miles redemptions is still significantly better than that of paying out of pocket. You are actually better off booking during the peak seasons to ensure you get the best value for your points. So how do you do it?

HOW DO I EARN ENOUGH POINTS AND MILES TO TRAVEL FOR FREE?

This is the million dollar question isn’t it? As much as we’d love to say it’s extremely quick and easy, that isn’t always the case. Otherwise everyone would be doing this. It does take time, research, and sometimes changes in habit. But we promise you the end result is worth it.

First, you’ll want to determine what your priorities are. Are you aiming for free or reduced flights? Or are you aiming for free hotel stays? Do you already have loyalty to any airline or hotel brands? These are things you’ll want to determine up front.

Second, are there any specific trips you’re wanting to take, or are you wanting to make it so you can take advantage of these benefits for all of your future trips?

Once you’ve answered these, we’d recommend making sure you’ve signed up for any relevant loyalty programs if you aren’t already. Here are a few of the major programs:

FREQUENT FLIER PROGRAMS

- American Airlines AAdvantage

- United Airlines MileagePlus

- Delta Airlines SkyMiles

- Southwest Airlines Rapid Rewards

HOTEL LOYALTY PROGRAMS

Next is the challenging part. If you have strong loyalty towards any of the above brands, and only wish to fly or stay with those brands, we’d recommend looking at some of the co-branded credit cards (bank and brand shared credit card) that each of them have. That being said, you will often not get the best points and miles earnings through these cards. Some do have major benefits to holding, such as the Chase World of Hyatt credit card, which gives you automatic Discoverist elite status just for holding the card, and allows you to earn elite status nights just from the spending on the card, which is unique to Hyatt.

If you aren’t specifically loyal to any one brand, then we’d highly recommend signing up for one of Chase’s Sapphire cards: Sapphire Preferred or Sapphire Reserve. What sets these apart from other credit cards is Chase’s Ultimate Rewards Program. This program is exclusive to only a number of Chase’s credit cards. Not only do these cards have some of the highest cents per point value (meaning you earn more points for lesser spending) but they have a network of brand partners that allow you transfer your rewards points 1:1 to these brand’s loyalty programs.

For example, let’s say you have 50,000 Ultimate Rewards points, and want to book a flight with Southwest, you can transfer these 50,000 points to your Southwest Rapid Rewards account for the full amount. Most other credit card points transfers result in devalued transfers meaning your 50,000 rewards points may only be worth a fraction of the points for the partner. Think of it like currency exchanges, and as long as you’re transferring with one of Chase’s partners, it will always be a 1:1 transfer exchange. Here’s a list of all 13 of their partners:

AIRLINE PARTNERS

- British Airways

- United Airlines

- Southwest Airlines

- JetBlue Airlines

- Virgin Atlantic Airlines

- Singapore Airlines

- KLM Airlines

- Emirates Airlines

- Aer Lingus Airlines

- Iberia Airlines

HOTEL PARTNERS

CREDIT CARD SIGN-UP BONUSES

The quickest way to build up your points or miles bank is through credit card sign-up bonuses. In nearly every case, any credit card that has a rewards program, has a sign-up bonus to incentivize signing up for their card specifically. So whether you are just starting out, or you’re trying to save up for a specific trip, or maybe you just want to build up a nest egg of points, taking advantage of these sign-up bonuses is a quick way to get there. Here’s a few examples of some of the current offers:

CHASE CREDIT CARDS

- Sapphire Preferred – 60,000 points

- Sapphire Reserve – 50,000 points

- Southwest Rapid Rewards Priority – 40,000 points

- World of Hyatt – 50,000 points

- World of Hyatt Business – 60,000 points

- United Explorer – 40,000 points

- Marriott Bonvoy Bold – 30,000 points

CITIBANK CREDIT CARDS

- AAdvantage Platinum Select – 50,000 points

BARCLAYS CREDIT CARDS

- AAdvantage Aviator Red – 60,000 points

CAPITAL ONE CREDIT CARDS

- Venture Rewards – 50,000 points

SPENDING

The last piece to this puzzle is the spending. Now we mentioned earlier on, that doing this correctly should not result in unnecessary spending. Managing your finances responsibly should always be the priority. If you have not owned a credit card previously, have poor credit, or are unable to make payments on time, then this may not be a priority. The goal here, is simply, if you are already managing a credit card responsibly, then simply utilizing the right credit card, for the right things, could help you offset your out of pocket expenses for travel. A year of using the right credit card, could provide you with that dream vacation you have been wishing for!

Many of these cards have categories of spending which earn points and miles at different rates. Travel and dining may earn you 3x points, while groceries and gas may earn you 2x points. So knowing when and where to use which card is especially important to ensure you are maximizing your earning potential. It wouldn’t make sense to use a card that only gets you 1x on groceries if you have a card that will get you 3x points. If done responsibly, having 2-3 cards that you rotate between to earn you the highest amount of points can provide major dividends. Check out our HOW MANY CREDIT CARDS SHOULD YOU OWN? article to find out what the right amount of credit cards is to own. You’ll be surprised!

BOTTOM LINE

We understand the time and effort to manage multiple credit cards, multiple loyalty programs, searching and researching the best times to travel and stay at specific locations can be quite daunting. But we feel like the time spent doing this little bit of work, more than outweighs the prices you might pay by not doing this work. And if you can get a free stay, or a discounted flight because of a little time and effort, well, we’d like to think that’s pretty worth it. Here’s a quick checklist of things to do:

- Determine what your priorities are. Do you want to travel often, or would you just like to cover the costs of that one big trip per year?

- Decide if you have any brand loyalty? Will you only stay a Hilton locations, or will you only fly on Southwest?

- Sign up for any loyalty programs you wish you be apart of. We’d recommend at least 1-2 airline programs, and 1-2 hotel programs. It might be worth seeing which airlines primarily fly out of your local airport and which hotel chains have locations in the places you’d most like to visit.

- Determine if and which credit card you should be using based on your priorities. For those of you who have loyalty towards a specific brand, then maybe their co-branded card is the right option. If you don’t have loyalty towards a specific brand, and are looking for a card that will provide you the most flexibility and earning, then we’d highly recommend either the Chase Sapphire Preffered or Reserve. When signing up for a new card, check to see what the spending requirements are to receive the bonus to make sure it isn’t outside of your usual spending habits.

- Lastly, once you have your primary card, look at the earning categories and make sure you’re using it in the right places. You want to earn as much as you can from your normal spending habits.

We’ll leave you with one last example. An example of a trip we’ve booked entirely on points and miles. This required very strategic planning and usage of cards, but it gives you an idea of what the possibilities are:

- 2 Business-Class round trip flights from San Jose California to Tokyo Japan – 210,000 American AAdvantage miles & $150 in taxes and fees

- 12 nights of stays at various Hyatt locations through out Japan – 280,000 World of Hyatt points (avg 23,000 points per night)

- Only additional cash expenses will be food, activities and in-country travel, but our hotel and airfare was essentially free

We hope this provided you with a better understanding of what points and miles are. And more importantly, the benefit of them, as well as a peak in to earning and redeeming them properly. Let us know what you think below, and if you have any follow-up questions to any of this!